Purchasing Real Estate in Portugal: Important Information on Legal and Tax Issues

Legal Matters

a) Hire a lawyer

First, you need to get a lawyer that deals in Portuguese real estate law. They will take care of ensure all legitimacy is confirmed, including ownership checks, and are safeguarded from any nasty surprises.

b) Do your research (Due Diligence)

Before committing yourself, it is imperative that you verify that the real estate in question does not have any legal problem associated with it. This is where your lawyer comes in. For example, he or she will supply:

Certidão Permanente (Land Registry Certificate): It is the official document confirming the title holder and the limitations to the property.

Caderneta Predial (Tax Certificate): Document that shows the real estate and its tax valuation.

Licença de Utilização (Usage License): A document that proves that the property approved and is ready for use.

Energy Certificate: A certificate that states the energy performance of a property.

c) The Promissory Contract (CPCV)

After all inspections are clear, we and the seller will execute a Promissory Contract (CPCV). This document stipulates the terms and conditions of the sale including a deposit, which is usually between 10 and 30 percent of the total price.

d) The Final Step: Escritura (Deed)

As a last step, the property is brought under your name. At this stage, it is appropriate to congratulate the new owner: from now on, the individual is a homeowner. To finalize ownership, you will need to sign the Escritura Publica de Compra e Venda (Public Deed Of Sale And Purchase) before a notary and the property is transferred under your name.

Tax Considerations

a) Taxes When You Buy

When completing on your property in Portugal you are required to make several initial tax payments:

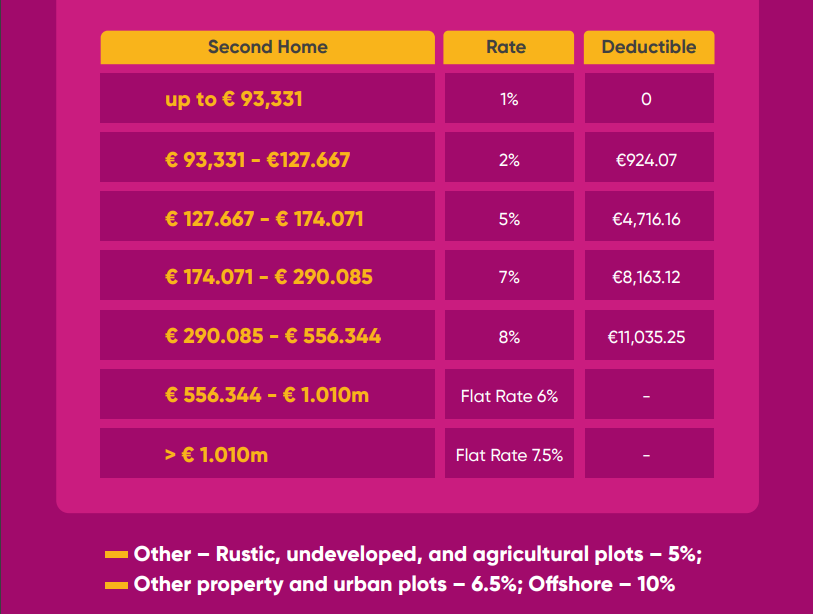

IMT (Imposto Municipal sobre Transmissao de Propriedade) – Property Transfer Tax. It's value varies depending on the type and value of property (0% to 8%).

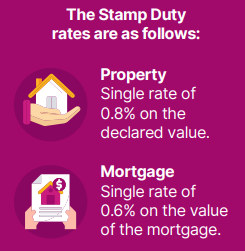

Stamp Duty– Tax levied in the amount of 0.8% of the purchase amount.

Administrative costs for notary and registration – Generally between €1,000 and €2000.

Yield for this property is over 5%

Yield for this property is over 5% Yield for this property is 3-5%

Yield for this property is 3-5% Yield for this property is below 3%

Yield for this property is below 3%